Gilbert Meher partnered with Ancala Partners to appoint the new CEO of Iris Care Group, a specialist complex mental health provider. This executive search case study explores the brief, our tailored recruitment strategy, and how we successfully placed Andy Jones, former COO of Nuffield Health, to lead the organisation through its next stage of growth and transformation.

Strategic leadership hires and responsive interim solutions delivered through a trusted, long-term relationship.

Gilbert Meher successfully led an executive search to appoint the new CEO of the Royal College of Chiropractors, to guide the charity into its next chapter.

In this issue, we will take a closer look at #DigitalPathology to understand how digital technologies are redefining pathology.

Avoiding the Trap of Interviewer Bias in Recruitment | Inclusive and Fair Hiring Guide by Gilbert Meher

Choosing a career in working with individuals with autism and learning disabilities offers a dynamic and fulfilling journey, filled with opportunities to promote independence and embrace diversity of each day. Matthew Brown, Head of Social Care at here at Gilbert Meher has composed a list of why working in this specialised field within Social Care is so compelling.

Explore the interplay between Artificial Intelligence and Emotional Intelligence in modern recruitment, and how it shapes successful hiring strategies.

Unlock the secrets of thriving in the ever-changing recruitment landscape with Natalie Walker's indispensable tips for success.

An employer’s first introduction to you is your CV, so we've prepared our top tips to land you your first job in Life Sciences.

We are excited for our new starters to join in the academy in the coming weeks. We have worked hard to make this a slick and seamless process for anyone we invite through and it’s proving to be working well so far!

In partnership with Hallmark Care Homes, the Gilbert Meher and Ada Meher teams will be running in the Jane Tomlinson Run For All Leeds 10k on July 3rd.

As part of our Women in Leadership Campaign, we recently sat down with Greg Eppink, a senior leader in the Life Sciences industry with a strong track-record of commercial success.

Here are our top tips for managing job search anxiety and maintaining a positive mindset.

We are excited to announce the launch of our Gilbert Meher | Science page.

Finding a job isn't easy but here's 7 ways a recruitment consultant can make it a walk in the park.

Recently, Gilbert Meher rewarded its top billers with an all-expenses paid trip to the beautiful Barcelona in southern Spain.

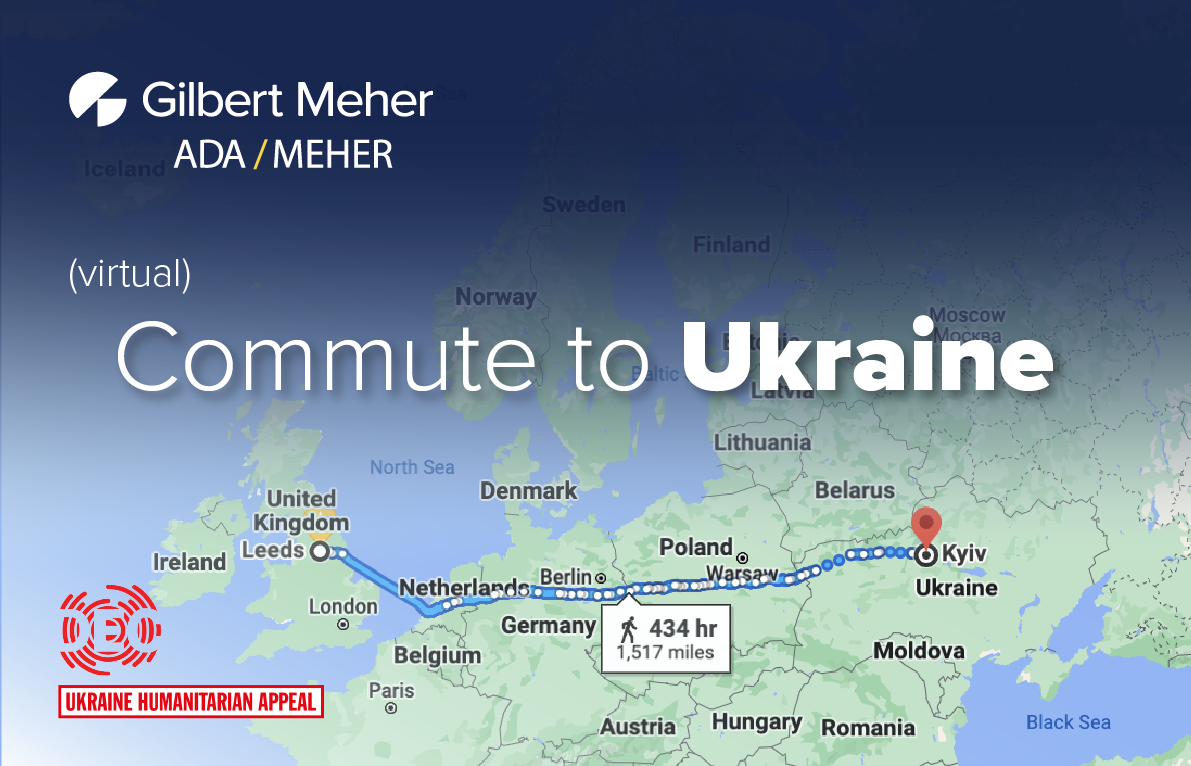

As a result of the catastrophic situation in Eastern Europe, the teams at Gilbert Meher and Ada Meher have rallied together to launch a (virtual) ‘Commute to Ukraine’ campaign to raise money for those in need.

Gilbert Meher are pleased to announce the promotion of Dawid Drygiel to Operations Manager.

Take a closer look at the UK Government's promise of social care funding as we delve in to what it really means...

79% of interviews are conducted remotely, read our top tips and tricks to help you ace your next online interview.

Tuesday 2nd November 2021 marked a huge day in the disabled community...

At this year’s Care Show, our founding director Jonathon Brooks was honoured to have been invited to discuss ‘Improving the experience of disabled people in social care’ on the main stage...

That’s a decade of building lasting relationships with clients; and a decade that the people we placed have been making a difference in the lives of tens of thousands of people all over the UK.

The 'search' element of Executive Search, or 'sourcing' as it is sometimes known, is possibly the most crucial stage of the recruitment process...

Gilbert Meher’s Executive Search team played a crucial role to deliver a strong Q3 performance for the company, which covered assignments in February, March, and April 2021.

Gilbert Meher is pleased to support the Government’s Kickstart scheme, aimed at getting 16–24-year-olds into employment.

How to get that job you've always dreamed of...

Over the past 10 months, Gilbert Meher has been working around the clock to extend our partnership with the care community.

Gilbert Meher has promoted Corrie Keable into newly created role, UK Client Development Manager.

Gilbert Meher successfully recruit new Interim Commissioning Manager...

Video interviews are here to stay. Learn how to make the best impression through the small screen...

We understand the urgent need to find experienced Care Home Managers.

Gilbert Meher successfully place new Home Manager at Brighterkind...

On the hunt for a specialist Executive Director in Senior Living...

Gilbert Meher successfully place new Finance Director at Excelcare...

The search for a Director of Operations in social care...

On the hunt for a Business Development Manager in Medical Devices...

Gilbert Meher place impressive new Home Manager at Majesticare...